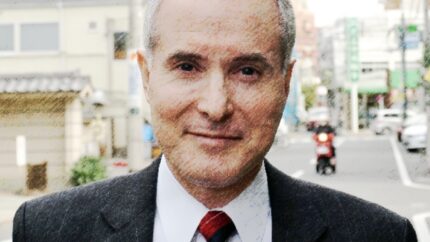

Nicholas (“Nick”) Benes was the first person in my sphere of recognition that raised a loud and clear voice regarding the need to improve corporate governance in Japan. He laid the groundwork that eventually led to the implementation of the corporate governance code in 2014, as a part of the “third arrow” in “Abenomics,” the growth strategy of Prime Minister Abe. Nick talks fast and acts fast, and I believe his passion and determination are reflections of his professional and personal desire to do good for society. He describes himself as a “monkey”… What do you think?

https://www.linkedin.com/in/nicholasbenes/

Nick and I first met at JP Morgan in mid 80s, and I knew him as my “senpai” (senior classmate) at UCLA business school. He was member of a large research team led by Professor Bill Ouchi, who had become renowned for his very popular book, “Theory Z.” The research was a sequel project funded by the US Navy, and its conclusions were later published as “The M-Form Society.” The thesis was that there was something about the multi-divisional structure of the Japanese society that allowed loose clannish organizations to interlace with each other to form a more efficient system, thus leading to better public policy.

Nick was always interested in the intersection between law and management, and that intersection was policy. He believes his interest in policy stems from his family background. Nick describes himself as a serial-immigrant, a son of immigrant to the US from Czechoslovakia. During World War II, his great uncle Edvard Benes was president of Czechoslovakia, and his family had to flee in exile.

Nick’s father, currently in his 90s is doing well, and was a probability mathematician at Bell Laboratories, which was then the place to be for high-tech research and development. But the probability that Nick would become immersed in anything to do with Japan was not that high. Living up in the East Coast, Nick doesn’t remember seeing a single Asian looking face till he entered high school.

His university studies led him to Stanford on the West Coast, where there was more of an Asian context. He remembers as part of his mandatory courses, he read huge textbooks on western civilization, when a couple of pages on the Meiji Restoration caught his eye. Nick was fascinated. How could a non-European country industrialize so quickly? What was the secret?

He started to take every course on Japan, but as he was a “doer” and liked adventure. Nick came to Japan during his sophomore year to study at Sophia University, went back to Stanford, and then again returned to study at Keio University during his third year. Returning to the US, Nick married a lovely Japanese woman, whom he is still with, and came back to Japan to live in Hokkaido for a while. Then he returned to UCLA to earn a law degree, and after a summer internship at Baker & McKenzie, found that he did not like the legal practice nearly as much as business topics, and decided to go to also get an MBA degree at UCLA.

When he first joined JP Morgan, his first assignment was in their swaps group in New York and then Tokyo. He invented a new product called the “inverse floater” (a bond with a coupon rate that varies inversely with a benchmark interest rate), but his boss would not allow him to sell it because the profits would be booked in London instead of Tokyo. So, the client asked Morgan Stanley to duplicate the bond structure, which they happily complied for a $200 million private placement, immediately followed by others over the next few years in large amounts. To Nick, this was a governance malfunctionof sorts. JP Morgan had missed tens of millions of profit because of office politics.

Nick also worked in M&A group, the Real Estate Group, and then the Equity Group, which was just starting up at JP Morgan. In 1993 after the Japanese “bubble” had burst, when the Nikkei was trading around 15,000, Nick presciently wrote a report that laid out his analysis that the market would not “clear” until Nikkei fell to 6000 or 7000. (In 2003, it traded briefly below 8000, and then again briefly touched 7000 in 2009.)

Nick left JP Morgan in 1994 because he wanted to go into the M&A business, especially in the so-called “middle market”, where he thought that there were uncharted opportunities, and formed Kamakura Corporation (a boutique advisory firm) with a partner.

So, Nick’s first interaction with Japan was when the world thought that there was something very good going on there. Now, it seems as though things have shifted180 degrees in the other direction, to the point where Japan apparently cannot do anything right. Nick freely admits that his creed is to say what needs to be said and not give up. When he was a freshman in college, recognition regarding Japan’s emerging fast economic growth was so low that his mother said that she would not pay for his visit to Japan. Japan subsequently took off just as he had predicted, but then the during the bubble years, behind the scenes doing transactions, he started to see what goes wrong when good governance doesn’t work, and it was not a pretty sight.

Over time, Nick got interested on the policy side of corporate governance. Rather than only focusing only on the rapid, optimal allocation of assets that could occur M&A transactions, over time his focus shifted towards improving management at companies and the economy overall, and thus avoiding pain or damage incurred by both shareholders and ordinary people, especially employees. He came to this point of view because he once sat on the board of a company that went bankrupt, and he saw how painful it was for everyone involved. Nick acknowldeges that he is critical of certain things, but that is just because he is trying to improve the system for the better.

What drives Nick on the topic of sustainability, not just in Japan but around the world, is that somebody must raise a voice to save civilization for his grandchildren. And he believes shareholder value is a part of that.

Nick believes his lifework on corporate governance has its genesis in Professor Ouchi’s project on organizational design. In addition, his policy-making mind, came from his family identity — Norbert Weiner, the creator of the science of “Cybernetics” was a granduncle, and former national security advisor Zbigniew Brzezinki was his uncle.

As a child, Nick had a dream to leave his mark on the world. Not just to rant and rave, but to have actual impact. Nick wants to be remembered as a guy who did some good deeds, someone who actually got things done.

His passion for corporate governance led him in 2009 to establish BDTI (The Board Director Training Institute of Japan), a certified “public-interest” nonprofit organization which is inspected periodically by the Cabinet Office. Japanese taxpaying donors to BDTI receive tax credit incentives, yet 99% of funding for the organization comes from overseas investors. Nick believes that one of the reasons is that many Japanese fund managers have never sat on the board of a public company, and therefore do not have enough of a notion of what can go wrong, or what does not happen that should.

About 70% of the participants in BDTI’s training program are internal executive officers that are likely to be nominated as a board director. A big “Aha” moment for many of them is simply learning the fundamentals of financial statements, and realizing how much more they need to study modern corporate finance, as well as fundamentals of the law and the governance code. They realize for the first time how little they knew before, and how unprepared they are.

For most, being named as a board director is just another internal promotion, and so they do not view it as crossing the line to the other side – sort of like entering a church or temple, in Nick’s words. If internal board directors do not speak up about topics and divisions other than those related to the department that they are directly in charge of, it is a wasted board seat, Nick believes.

The good news is that if you had told Nick 8 years ago that he would propose a corporate governance code and it would be in place in corporate Japan two years later, he would not have believed it. Now, that it is in place, most Japanese companies generally try to follow the rules.

So, the structure is in place, but what about the essence? Nick believes that habits and behavioral patterns tending towards consensus and avoiding confrontation are difficult to change, but at any rate, it is okay (in fact, essential) to be able to disagree with people when necessary. However, without frameworks for doing so, this change won’t occur at all.

Nick points to three things that moved the needle regarding corporate governance in Japan. One was the ACCJ’s (American Chmber of Commerce in Japan) 2010 Growth Strategy Task Force White Paper project , which he initiated and led. In 100 pages of economic analysis and another 100 pagers of policy proposals, it pointed out that the only way to avoid the fiscal and demographic cliffs facing Japan was to increase productivity. The White Paper was well read within the Japanese government, and was used in 2013 as a blueprint for Prime Minister Abe’s “Abenomics” third arrow, structural reform.

Once the government had embraced the goal of enhancing productivity, this gave Nick a path to propose the corporate governance code. At that point, the second important factor was his connection with Yasushi Shiozaki, a senior LDP parliamentarian who not only could understand the concept, but also took immediate action. The 2013 Abenomics “growth strategy” did not have enough concrete measures and substance regarding structural reform, so Shiozaki went directly to the FSA (Financial Supervisory Agency) and TSE (Tokyo Stock Exchange) to get things moving. Nick had advised Shiozaki to put the governance code in the hands of the FSA, because he felt METI (Ministry of Economy Trade & Industry) historically had been influenced by “regulatory capture”, whereby regulators are overly influenced by those whom they regulate. In this case, the parties being regulated were corporations, led by the Keidanren (Japan Business Federation), an organization mainly comprising large Japanese “salary-man” corporations.

With this the third important factor, Nick gave a speech to an LDP committee, and the policy to create a corporate governance code quickly came into existence shortly thereafter. At that time, Prime Minister Abe and Minister of Finance Aso were hungry to put more meat on their structural reform proposals in June of 2014. The establishment of the stewardship code also gave a boost to things. The concept of a stewardship code had first been suggested by Takeshi Niinami (CEO of Suntory Corporation, and the first guest on this Made With Japan podcast), On the first page of his speech, Nick made the point that the stewardship code could not function effectively unless a corporate governance code was created and required disclosure about companies’ governance practices.

One problem with the stewardship code in Japan, compared to that of the UK, is that the former does not encourage collective action. In the UK, if an investor wants to talk to other investors to collaborate in order to present suggestions regarding an important management issue, that is not difficult to do; in fact, it is actively encouraged. But, in Japan, if such a group of investors collectively own more than 5% of a company, the members of that group will have to file a “joint holders’ report” and submit to a burdensome reporting regime that is separate from the ordinary one.

As a council member of the New Form of Capitalism established by Prime Minister Kishida, I believe the important aspect of that policy is to facilitate the consideration of externalities (environmental and social issues) that have heretofore been overlooked in valuing corporations. The policy is about focusing on fact that companies must serve the needs of multiple stakeholders and society, while not ignoring shareholders.

Nick admits that he is a bit of the “old school”, being trained in law. One part of his heart wants companies to do good for society, but because of the trade-off problem, it is impossible to satisfy everyone at once. Furthermore, the legal reality is that shareholders are the owners of the company. He however feels that there is room for discussion regarding things like employee shareholder action, or employee representatives on the board, but industry leaders tend to hate this idea.

Having the interests of the shareholders, executives and asset managers aligned is important for ESG and SDGs investment. Nick feels that these are essential concepts for the future, but in practice and the present reality, various structural and compensation incentives in our equity markets all tend to run in the wrong direction. He feels that we need to give much deeper thought to altering incentives throughout the investment chain, so that stock prices reflect long-term sustainability much more dependably.

I asked Nick if it is possible for companies to express their preference towards a certain segment of investors, while having the same legal obligations and fair disclosure to all investors. Nick felt that they can, but only if existing shareholders agree with it. If they don’t, the existing shareholders can vote out the management, and one cannot get away from that reality.

Nick notes that distribution of profits to wages for employees is decreasing all over the world, especially in Japan, and in order to change this situation, efficiency of the labor market must be improved by enabling greater job mobility. For example, in Japan’s case this would require allowing long term employee contracts that permit the company to fire employees if it pays fair severance pay. This will increase incentives for the company to train employees and increase their productivity, because otherwise it will waste money by paying severance costs. Conversely, if productivity can increased by improving the efficiency of labor-market “matching”, there is a built-in incentive for the company to pay higher wages.

Nick also floated an idea to form companies that must issue one special class of stock, such that that every time a share is traded, 15 basis points (0.15%) is taken out of the trade and put aside in a trust fund. This trust fund would be available to provide a cushion beyond the existing capital of the company to pay for externalities, should any arise. After seven years or so have passed, if this cumulative cushion did not have to be tapped because of responsible voting by shareholders for proper management decisions to prevent externalities, the shareholder would get the money back. This is an idea to create strong incentives for investors to think in the long term. It should be possible to create such a company even under current corporate law in Japan. The effect would be increased significantly if at the same time, executives, asset owner trustees, and asset manager alike were required to own the portfolio they managed or oversaw for seven years or more.

So as a final question, — as a “doer,” what animal would Nick characterize himself as? He quickly replied “monkey.” He was called a “pyro monkey” by one of his colleagues when he was trying clean up “fires” as a board member of a troubled company. He admits that his nature is to negotiate for better solutions, such that he may appear to be a bit combative to some. However, he believes somebody needs to say the things that need to be said but others do not say. Which I guess is like climbing a tall tree sometimes. But then again, yearning for the view from a higher ground is not a bad thing at all.